“Tired of Average Returns and Market Volatility? Learn the Strategies Some Investors Use to Grow More, Keep More, and Retire Sooner.

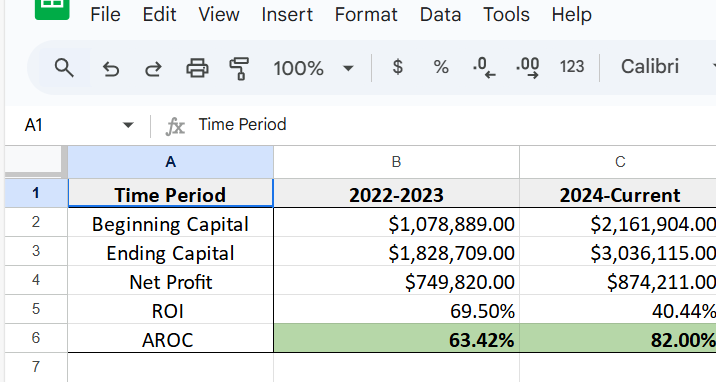

Take a look at one of my investment accounts over 2023–2024:

⚠️ Important Note: This is for educational purposes only. Past performance is not a guarantee of future results.

This reflects my individual account using strategies that I personally developed, tested, and refined over many years.

This screenshot shows how I applied a set of principles—covered in detail in my book—to manage risk, reallocate assets, and leverage compounding in a tax-efficient way.

I’m not sharing this to impress you.

I’m sharing it to illustrate what’s possible when you understand how to take more control of your investment strategy and move beyond “set it and forget it.”

Your results will depend on your decisions, discipline, goals, and market conditions.

In this account, I applied the same core principles I outline in the book. Nothing more, nothing less.

I wanted to demonstrate how a thoughtful, disciplined approach to investing can potentially lead to meaningful results over time.

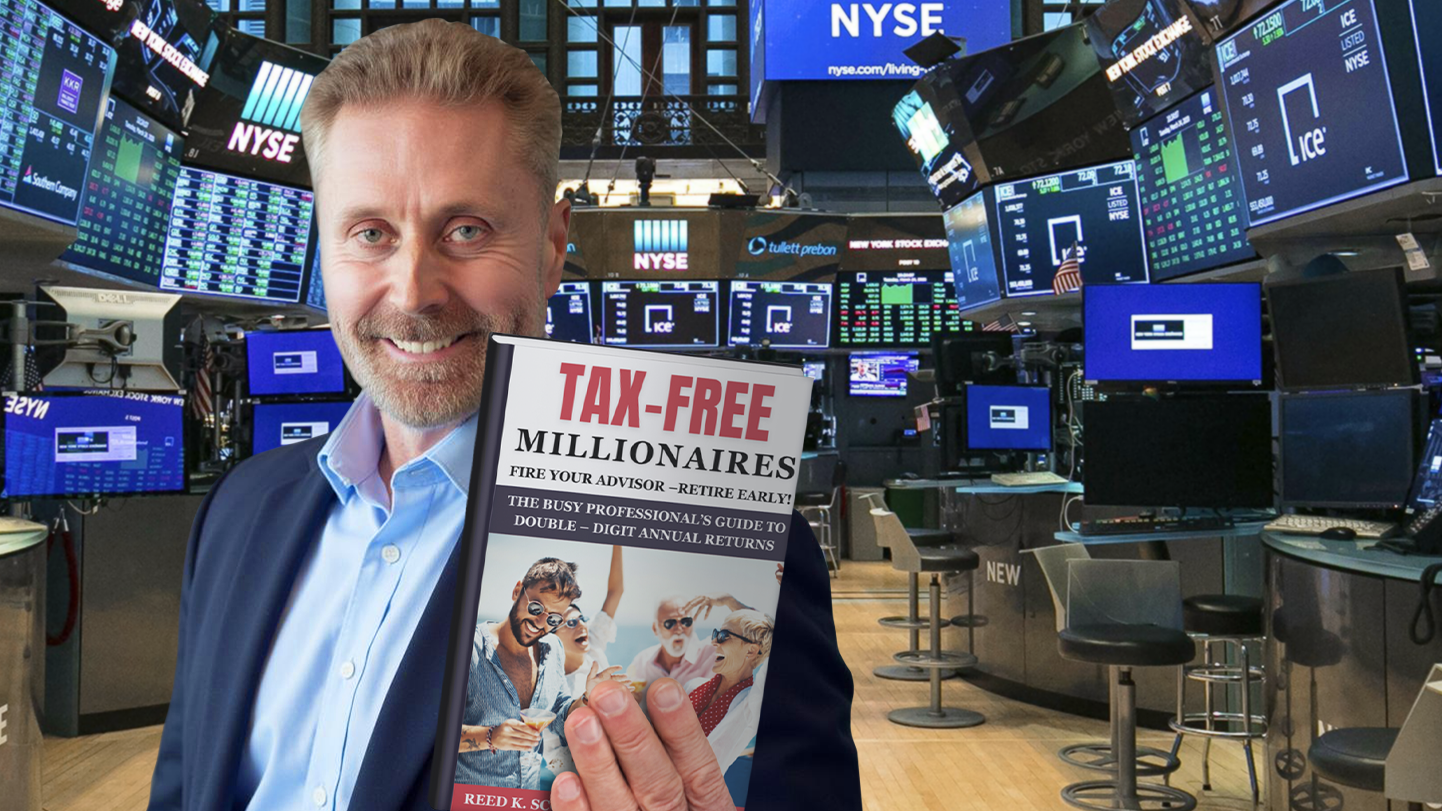

This book is about helping everyday investors build a smarter, more tax-efficient foundation for long-term growth.

And the best part? You can get my book for free right below, just pay for shipping and handling.

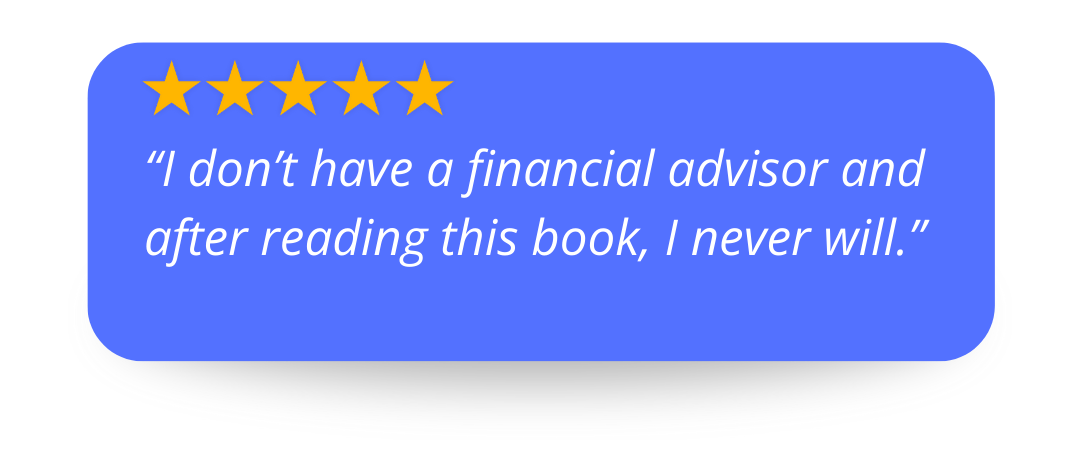

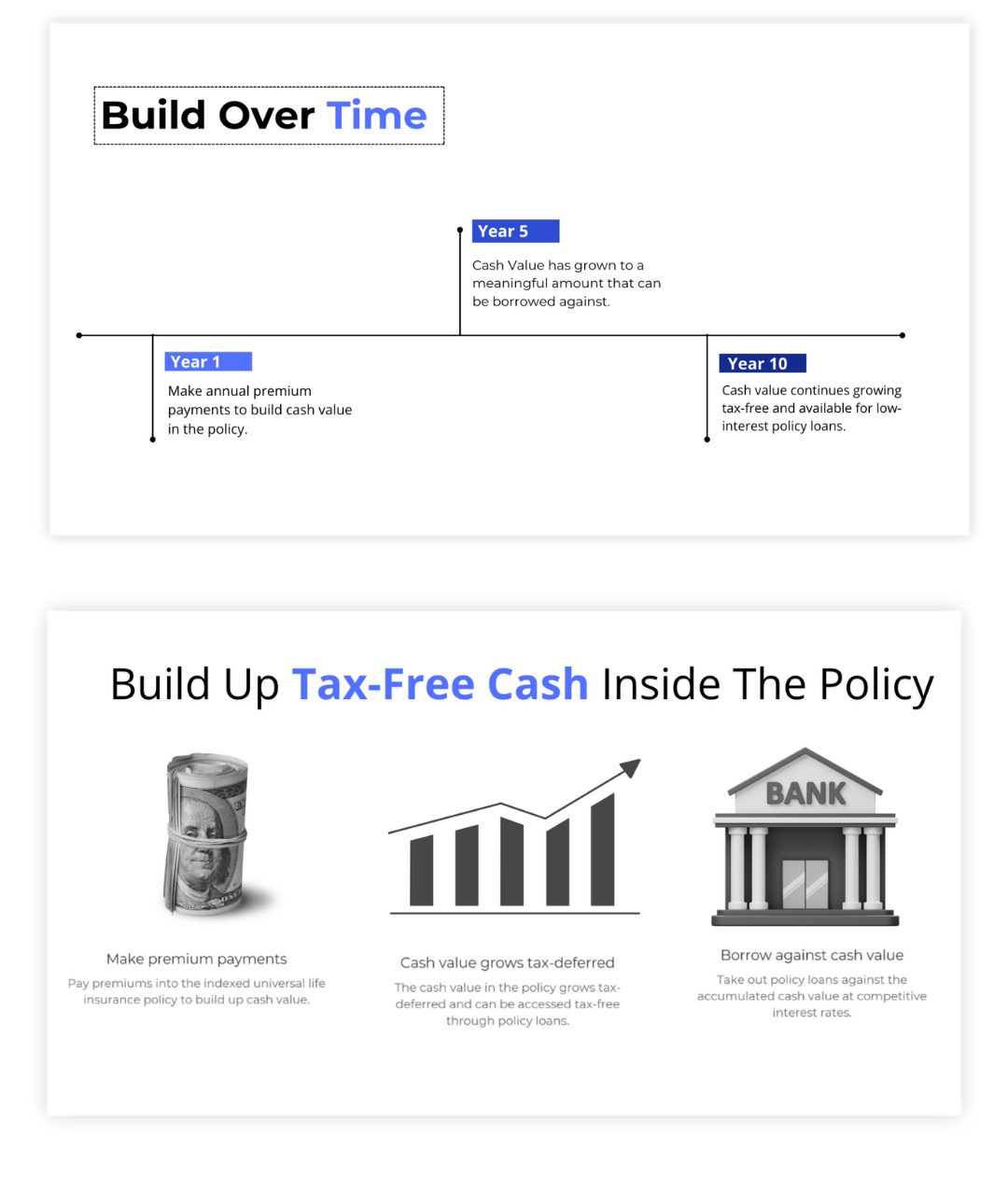

I will show you two scenarios.

☑

One focuses on more proactive, tax-efficient investing strategies designed to give you greater control and flexibility over your financial future.

🆇

The other reflects what most people do: contributing to a 401(k) or index fund, often with limited customization or awareness of long-term tax impact.

In this book you'll learn how certain tax-advantaged strategies could help offset the effects of inflation and rising tax rates over time.

I’ll walk you through the difference between a passive, one-size-fits-all investment approach and a more active, hands-on strategy.

The goal is to give you more control over where your money goes and how it grows.

In fact, I’ll introduce you to an asset class that most everyday investors overlook entirely.

You’ll see how I’ve personally used this investment type as part of a long-term, tax-conscious strategy and how it may complement your own plan.

(And no, it’s not real estate.)

From stock screening…

To the weekly reallocation…

Use options strategies to better manage risk, protect downside exposure, and strengthen your overall portfolio planning.

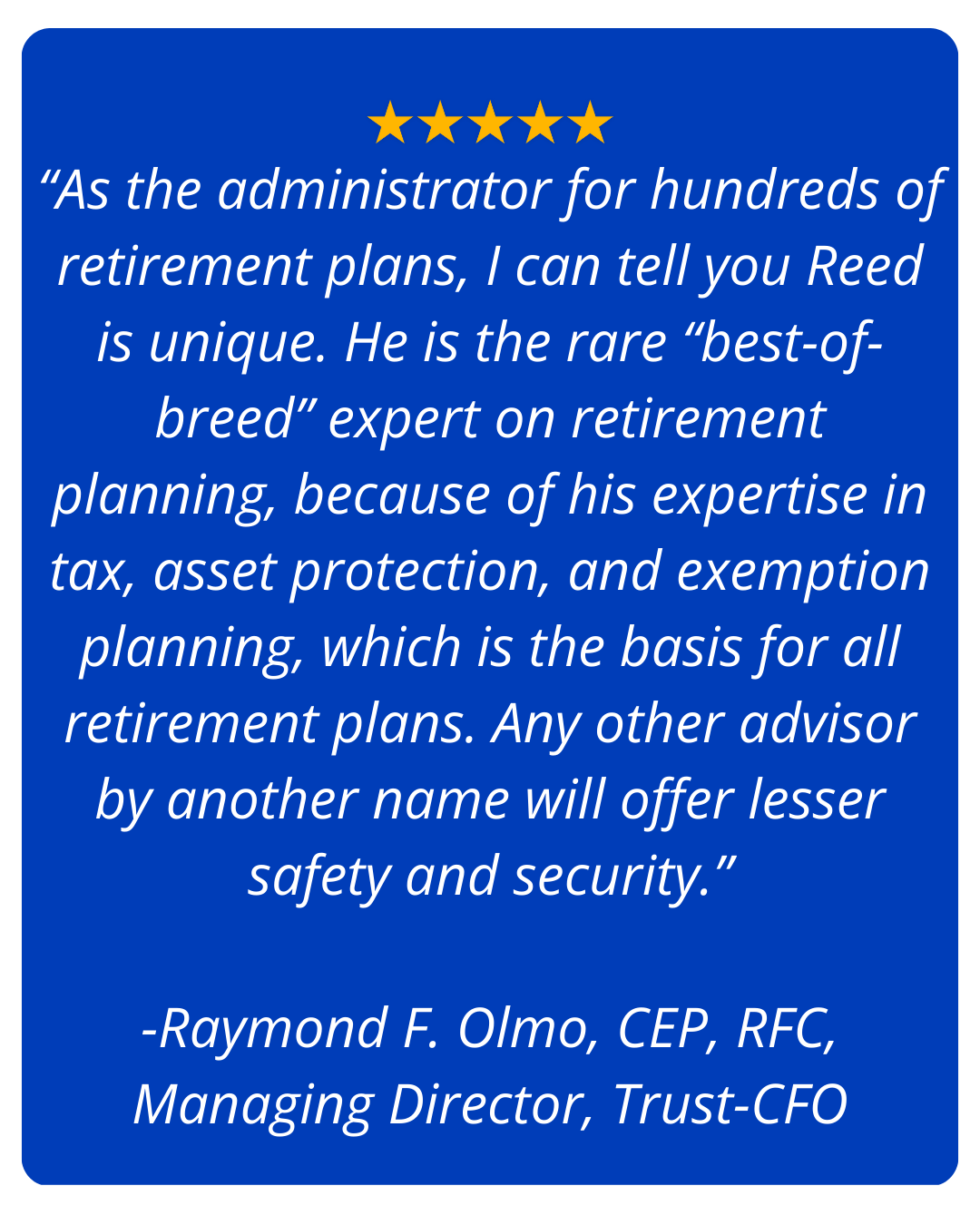

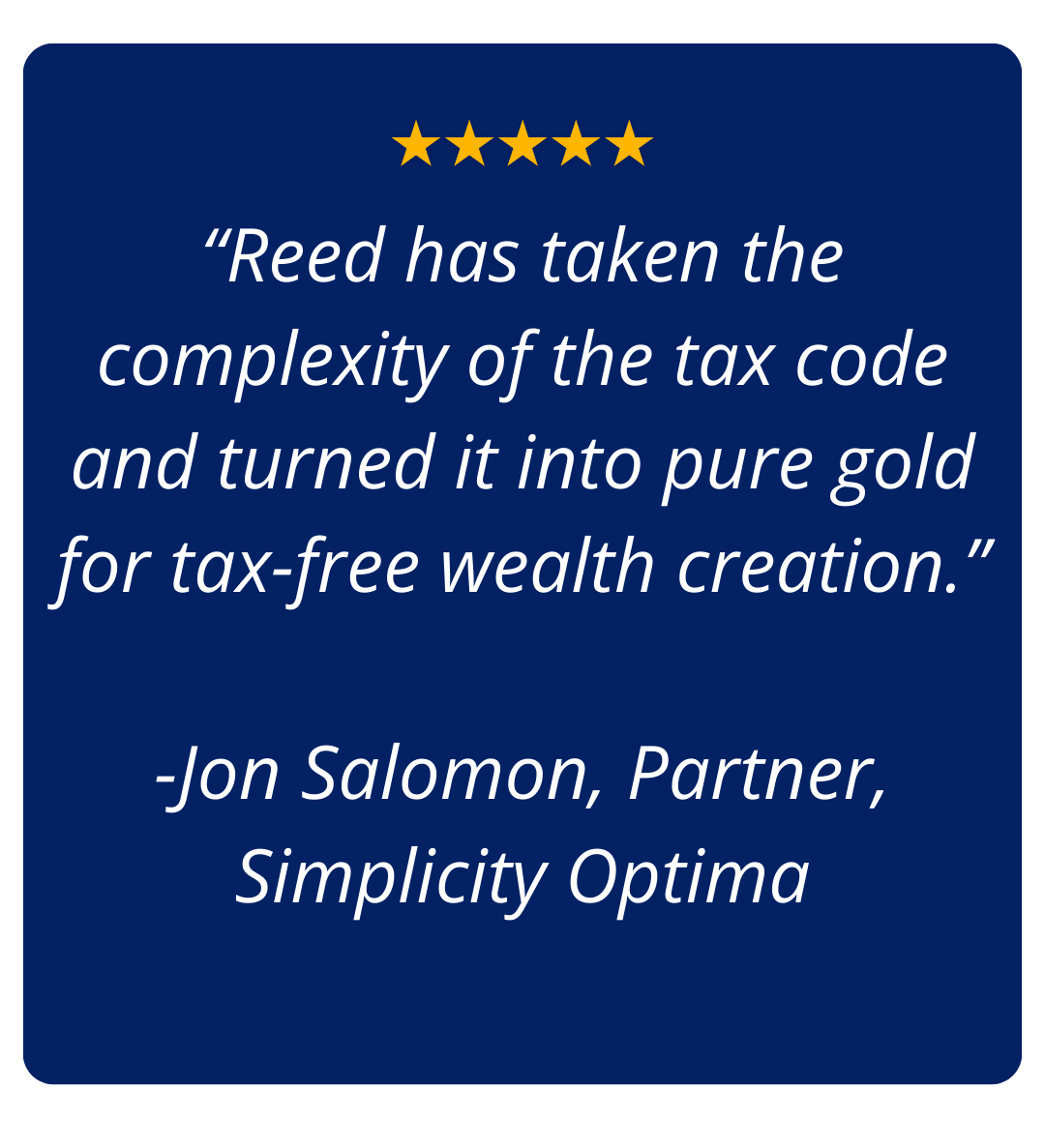

After working with high-net-worth clients for over twenty years, showing them how to create multiple sources of legal, tax-free income, I decided to develop a system that anyone could use to apply the same principles to their own investments.

Disclaimer: This content is provided for informational and educational purposes only and does not constitute financial, investment, legal, or tax advice. Any investment strategies discussed are not guarantees of future performance, and individual results will vary based on personal circumstances and market conditions. Always consult with a qualified financial advisor or tax professional before making investment decisions. Past performance is not indicative of future results. Tax treatment depends on individual circumstances and may change. This content is not intended to promote tax evasion or guarantee any specific financial outcome.